Monday, August 22, 2016

Stock in Asia Mixed as Oil Prices Fall and Dollar Loses Ground

Asian Shares gave mixed results on Tuesday, as oil prices fell and the U.S. dollar weakened ahead of a key meeting of Federal Reserve officials and other central bankers later this week.

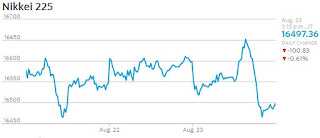

The Nikkei Stock Average lost 0.4%, while Australia’s S&P/ASX 200 were up by 0.8%. Hong Kong’s Hang Seng Index was down by 0.3%, while the Shanghai Composite Index gained 0.2%. The FTSE Bursa Malaysia KLCI was down 0.1%.

Crude-oil prices sank below $47 a barrel in New York overnight on skepticism the Organization of the Petroleum Exporting Countries (OPEC) would reach a deal to cut production, sending commodity stocks in Japan sharply lower. Oil explorer Inpex was down 1.9%, while Japan Petroleum Exploration slid 3.4%. Brent crude, the global benchmark, was recently down 1% from the previous close to $48.67 a barrel, a five-day low.

Copper three-month futures on the London Metal Exchange hovered near six-week lows, and share prices of mining companies on Australia’s benchmark index rose.

U.S. dollar slipped against other major currencies as the yield on the 10-year U.S. Treasury note fell to 1.55% from around 1.60%. The U.S. dollar index was recently down 0.1%. The yen rose 0.1% against the dollar, adding to pressure on Japanese exporters by making them less competitive, with auto makers Honda Motor falling 2.1% and Mazda Motor shedding 3% of its value.

BRAIN SUPPLEMENT

Friday, August 12, 2016

Macy's to close 100 stores, Legacy Retailers Hit Hard by Online Discount Stores

A lot of top retailers in the U.S. are feeling the heat, yes American consumer are still buying but they don't want to pay the full price and they want to shop at home. Legacy stores has been hit hard by this consumer shift. Macy’s, the largest department store in the U.S., announced on Thursday that they would close 100 stores. The company said that they were more valuable as real estate properties. The department store chain continues to shrink.

Well, all is not lost. Macy's has a plan and they also announced a series of strategic changes to lure shoppers. The plan includes bringing in more brand shops within the stores, improving online search and ordering and hosting in-store events to drive foot traffic.

The closure of 100 store is 15% of Macy's 675 full-line locations. It is only the latest round of closures Macy's has undertaken in recent years to rid the company of unprofitable stores. The company didn't identified the locations of stores that will close, but said they represent about $1 billion in annual sales, excluding sales the company expects to retain online or at nearby stores. That's nearly 4% of Macy's total annual sales in 2015.

Investors were happy about the latest news that send Macy's stock up 17% on Thursday to $39.81 a share, up $5.81. Still, the stock is down about 40% from its 52-week high.

Also Walmart, the world’s largest retailer, said on Monday that they would purchase a small online rival for more than $3 billion. The hope is that the deal will reverse its sputtering online growth.

Subscribe to:

Comments (Atom)